Williamsville

(716) 631-8300

East Aurora

(716) 652-5758

Standard Operating Procedures

Kristen Pask

Licensed Sales Agent

(716) 870-3122

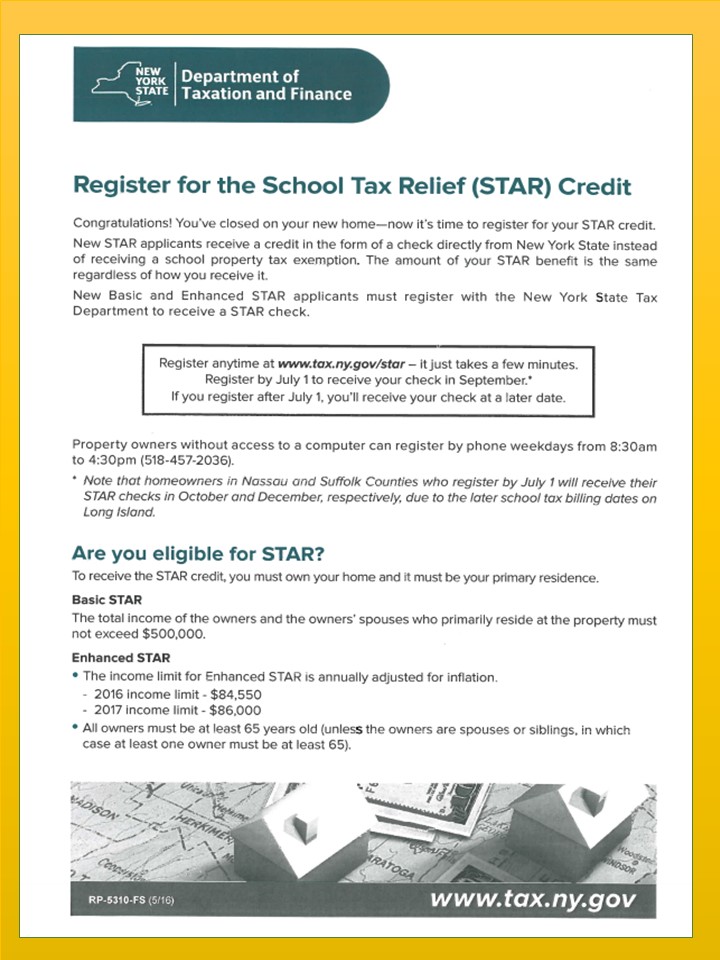

NY STAR Exemption

Do you qualify for the STAR exemption?

Whether you receive the STAR exemption or the credit, there are two types of STAR benefits:

Basic STAR

- available for owner-occupied, primary residences where the resident owners' and their spouses’ income is less than $500,000

- based on the first $30,000 of the full value of a home

Enhanced STAR

- provides an increased benefit for the primary residences of senior citizens (age 65 and older) with qualifying incomes ($84,550 or less)

- based on the first $65,300 of the full value of a home

The STAR benefit applies only to school district taxes. It doesn’t apply to property taxes for other purposes, such as county, town or city (though special rules apply in the state’s five biggest cities, namely, New York City, Buffalo, Rochester, Yonkers, and Syracuse).